Simon Roberts, University of Johannesburg and Ntombifuthi Tshabalala, University of Johannesburg

Global fertiliser suppliers have made incredibly high profits in 2022/23 on the back of price spikes attributed to the Russia-Ukraine war. The profits of the world’s top nine producers trebled in 2022 from two years previously.

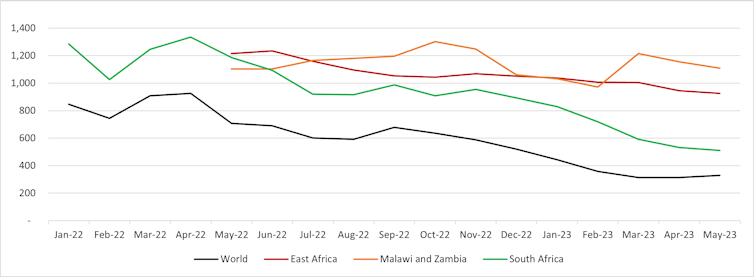

The margins and impacts have been even greater on fertiliser supplies to African farmers. Moreover, the super-high profit margins are being sustained in 2023 in many African countries even while international prices have come down (see figure 1). The harvest season has recently come to an end in most countries in southern Africa with farmer margins and production being squeezed by high input costs.

The wide gaps between fertiliser prices in the region and international fertiliser prices point to major issues within the supply chain with excess margins of some 30%-80% being earned on sales to many African countries.

South Africa has the benefit of robust competition enforcement meaning prices in this country have come down substantially. This only serves to highlight the disadvantage being faced by farmers in other countries such as Malawi and Zambia.

High fertiliser prices undermine production, contribute to high food prices, and exacerbate food insecurity.

Our work on fertiliser and agri-food markets in the African Market Observatory points to major problems with how international and regional markets work, including the market power of large international suppliers. High prices for fertiliser inputs are squeezing African farmers who are cutting back on fertiliser use meaning low yields and supply, and high food prices.

International action is therefore urgently required on fertiliser prices to improve food security in Africa.

Impact

African countries are dependent on imported fertiliser and usage is relatively low. For example, Kenya and Zambia use around 70kg/ha, compared with 365kg/ha in Brazil.

Production

The harvest season has recently come to an end in most countries in southern Africa. There’s evidence that farmer margins and production are being squeezed by high input costs. High costs and low application are a factor in maize yields in Zambia being less than half of those in South Africa and a third of Argentina (according to the FAO).

In 2022, Kenya imported almost 30% less fertiliser and production fell. Maize output in 2022/23 was 18% lower than the average for the previous five year, with yields and area planted both being lower, compounding the effect of poor rains. This has meant a substantial deficit relative to local demand and very high prices.

Continued high fertiliser prices will constrain production, even while there is a great need to expand agriculture output to meet regional demand.

For example, Zambia has abundant arable land and water for agriculture to increase production. Of the country’s 42 million hectares of arable land, only 15% (or around 6 million) is under cultivation, including for pasture, with only 1.5 million of this cultivated for crop production. Zambia has around 40% of the water resources available for agriculture in the entire SADC region.

If farmers earned better returns, with cheaper input costs, then production could be a multiple of the current levels.

Food insecurity: Approximately 73 million people in the East and Southern Africa region are experiencing acute food insecurity. People in low- and middle-income countries bear the harshest burden – both in terms of the importance of small-holder farmers and in the vulnerability of low-income urban households to high food prices.

Most countries on the continent rely on food imports. Countries such as Kenya which have been affected by drought are struggling to source imports which has worsened food security in the country. This has been exacerbated by export restrictions on maize imposed by Zambia and Tanzania, which have suppressed prices to farmers in those countries, even while input costs, notably fertilizer, have increased.

Uneven playing field

International fertilizer prices more than doubled in two months – from September to November 2021. The peak continued into early 2022, reaching an average price of US$915/t for the benchmark urea fertilizer between March and April 2022. This compares with around US$226 in the previous five years. This was driven by the world’s largest fertilizer companies taking advantage of the rise in the price of natural gas, an important input for nitrogen-based fertilizer, as well as supply disruptions associated with the Russia-Ukraine war. The fertilizer companies exploited the shocks and raised prices by more than the increase in costs.

By March 2023, the international price of urea had fallen back to close to $300/t. With additional costs to import to coastal countries which should be no more than $150/t and to inland regions no more than $250/t including a trader margin, South Africa’s inland prices now reflect fair prices but in other African countries super profits are continuing.

What needs to be done

To ease the adverse impacts of high fertilizer prices, governments in the region have tried to implement fertilizer subsidy programmes. For example, prices in Tanzania with the government subsidy have been reduced from around $1100/t to US$600-700/t.

But the subsidies have huge costs for governments which many African countries have not been able to incur, while the programmes have generally not been working well. In Malawi, for example, a large portion of the Affordable Inputs Programme (AIP) targeted beneficiaries did not receive fertilizer under the 2022/2023 programme.

International action is therefore urgently required on fertilizer prices to improve food security in Africa. First, competition authorities in Africa should investigate signs of anti-competitive conduct. Second, investments are required in logistics, storage and advice on optimal usage. Third, a fertilizer market observatory as the EU is currently setting-up would provide ongoing data about fertiliser markets, factors affecting them, and exchange experiences and good practices for optimal usage.![]()

Simon Roberts, Professor of Economics and Lead Researcher, Centre for Competition, Regulation and Economic Development, UJ, University of Johannesburg and Ntombifuthi Tshabalala, Economist at Centre for Competition, Regulation and Economic Development, University of Johannesburg

This article is republished from The Conversation under a Creative Commons license. Read the original article.