Yushu Zhu, Simon Fraser University

Driven by the neoliberal belief in the superiority of the free market, the housing policy in Canada has shifted from a welfare-oriented policy to a market-oriented one over the past four decades, encouraging home ownership, deregulation and private consumption.

Housing financialization, the transformation of housing from a human right to an investment opportunity, has been driven by the federal government primarily through financial market deregulation and a financial practice called mortgage securitization.

Much of the debate about the housing crisis has focused on the market imbalance between supply and demand, citing factors such as foreign investment and lack of market supply. However, many housing problems today need to be viewed in the historical context of the housing system restructuring, which keeps housing and wealth inequality alive and well.

Using the historical census data of five metropolitan areas — Toronto, Vancouver, Montreal, Edmonton and Calgary — from 1981 to 2016, our study reveals deeply entrenched housing inequality in accessing affordable housing in the post-1990s neoliberal era. Both neoliberal housing policies and housing financialization are important contributors to this intensified housing inequality.

Canada’s housing system: from welfare to neoliberal regime

Until the mid-1980s, Canada had a welfare housing regime with strong state intervention in social housing supply — first in the form of public housing financed and managed by the government, then in community housing developed by a mix of community groups with government funding and finance.

This welfare-oriented regime was transformed into a neoliberal regime in the 1990s, when the federal government moved away from social housing and started relying primarily on the private sector for housing supply.

Federal expenditure on housing programs dropped from nearly 1.5 per cent in 1981 to slightly over 0.6 per cent of the total federal expenditure in 2016. Since then, the social housing sector has become more “core-needs” targeted, supporting people with special needs and leaving those in need of independent social housing to the private market.

The 2000s marked the start of housing financialization in Canada. In 1999, responding to the demands of consumers and the financial sector, the federal government introduced Bill C-66 that aimed to turn the Canada Mortgage and Housing Corporation (CMHC) from home-builder to mortgage-insurer. With easier access to credits and lower interest rates, household savings were channelled into increasingly expensive housing markets, boosting housing demand and attracting financial capital into the profitable housing market.

More Canadian households face affordability problems over time

The neoliberalization of housing policy came with increased housing inequality. One outcome of housing financialization is the increase in residential mortgage debt to finance housing. The residential mortgage debt to GDP ratio rose from 26 per cent, to a whopping 68 per cent between 1981 and 2016.

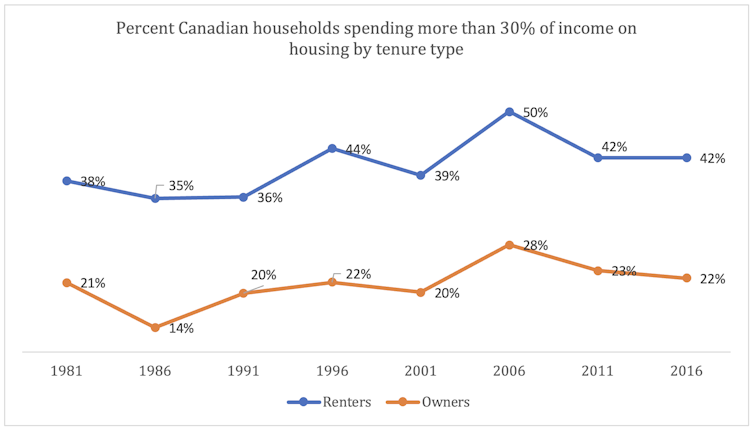

Our study uses the shelter-costs-to-income ratio (CIR) to assess housing affordability. Overall, the average CIRs across these five census metropolitan areas fluctuated modestly between 25 per cent and 33 per cent throughout the census years. Yet, more Canadian households have experienced housing unaffordability problems over time. The share of renter households that spend more than 30 per cent of their income on housing increased from 35 per cent to 42 per cent between 1986 and 2016. These numbers for owners increased from 14 per cent to 22 per cent during the same period.

Greater inequality in accessing affordable housing in the neoliberal era

The more commodified a housing sector, the more access to housing one would expect to have, contingent on an individual’s economic status rather than citizenship. Indeed, the gap in affordable housing access between income groups has enlarged in Canada.

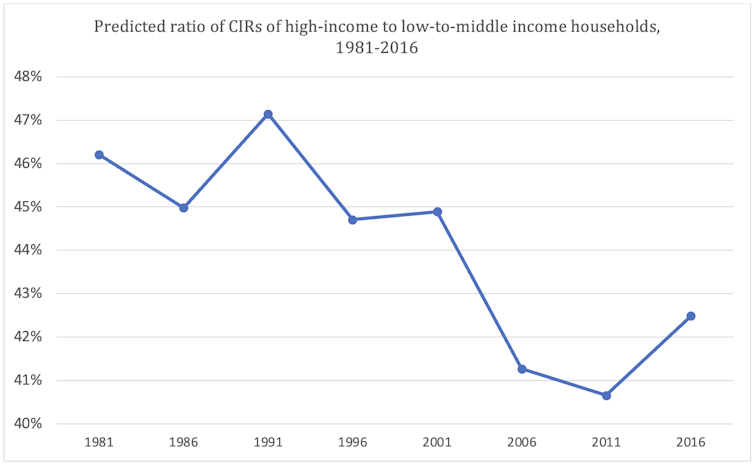

After taking factors such as household type and size and socio-demographic characteristics into consideration, we estimated that the average CIR for high-income households dropped from 46 per cent for low to middle-income income households, to 40 per cent post-2001. This suggests a greater gap in accessing affordable housing determined by income, and a more commodified housing sector in the neoliberal era.

The reduced federal expenditure on social housing and increasing residential-debt-to-GDP ratio, induced by housing financialization, shows significant effects on the rising housing unaffordability, among other macroeconomic factors such as GDP growth and unemployment rates.

While the withdrawal of the federal funding increased housing costs for both income groups, housing financialization exacerbated housing unaffordability only for low to middle-income households, while benefiting high-income households by improving housing affordability for them. This reflects the private market’s incluination to respond to the housing demand of those with stronger purchasing power, leading to reduced housing supply for those at the bottom of the income ladder and reinforcing housing inequality between the two income groups.

The vulnerability of low-income renters and young homeowners

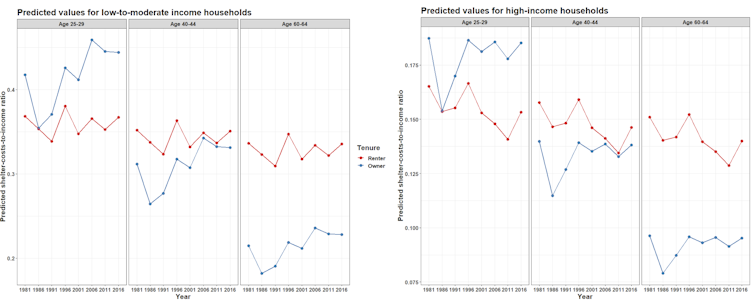

Housing commodification and financialization in the neoliberal era have had uneven impacts on Canadian households. Low to middle-income renters at all ages appear to encounter housing affordability stress, although their CIR remains relatively stable over time.

In contrast, the CIR for low to middle-income homeowners increased substantially over time. Young homeowners are the worst off due to easier access to mortgage loans and slow income improvement, representing a new form of housing vulnerability. While high-income homeowners have also experienced rising CIR over time, their CIR remain well below 30 per cent. High-income renters have seen improved affordability over the years.

Housing gaps widest among women and immigrants

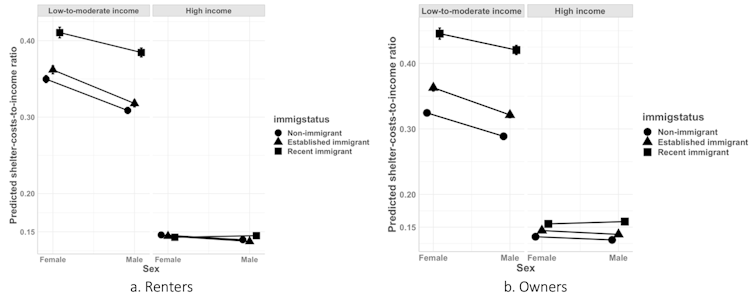

There are significant housing affordability gaps between different gender and immigrant groups. These disparities do exist regardless of housing tenure, but they were only present among low to middle-income households. While established immigrants tend to catch up with native-born Canadians, the gender gap persists among low-income households, regardless of immigrant status. This implies the existence of systemic barriers in low-income female-led households, such as male bias in the design and planning of the residential spaces in social housing.

Overall, Canada’s housing section is highly commodified, with income playing a major role in accessing affordable housing. To date, housing policies have mainly focused on market solutions, such as discouraging foreign investment or encouraging the market supply of affordable housing. However, the intensified market mechanism resulting from neoliberal housing policies has widened the housing disparity gap between the haves and the have-nots.

State institutions have been utilized and transformed to facilitate, rather than limit, the commodification and financialization of housing. It is vital for public policies to recognize the state as part of the housing problem and shift the policy narratives around housing unaffordability from simply a market disequilibrium problem, to a failure of state institutions.![]()

Yushu Zhu, Assistant Professor, Faculty of Urban Studies and Public Policy, Simon Fraser University

This article is republished from The Conversation under a Creative Commons license. Read the original article.