MV Ramana, University of British Columbia and Xiao Wei, University of British Columbia

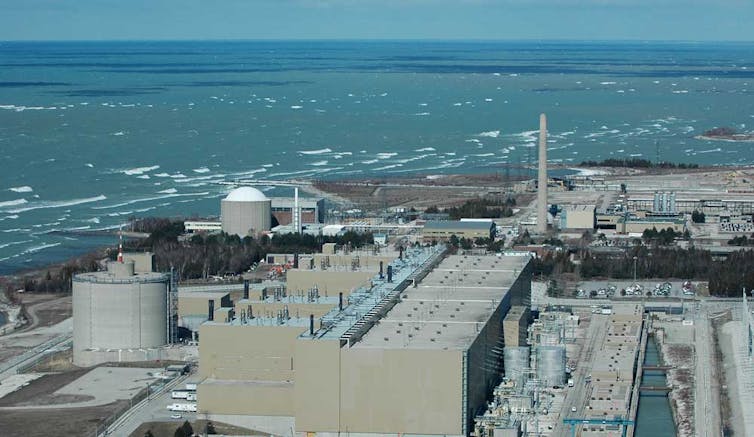

Ontario is working to refurbish 10 nuclear reactors at the Darlington and Bruce power plants at estimated costs of $12.8 billion and $13 billion respectively. In the months ahead, Ontario Power Generation expects to start the refurbishment process for one of the units at Darlington.

Because of a history of cost overruns with nuclear construction projects around the world, including Canada, this strategy comes with significant financial risks. In 2020, it’s critical to continuously re-evaluate whether proceeding with refurbishment makes economic sense.

In the first of these refurbishments, there is already evidence of cost overruns and delays. The question of whether to refurbish them becomes even more urgent in light of the rapidly declining costs of wind and solar energy, which also deliver electricity without emitting carbon dioxide.

We’re researchers who have examined the economics of electricity generation in Ontario, and we’ve demonstrated that as the costs of batteries decline, the cost of supplying electricity using a combination of renewables and battery storage would be cheaper than using nuclear power. We argue that it’s critical to examine Ontario’s commitment to these refurbishment plans.

Financial risks

In 2017, Ontario’s Financial Accountability Office highlighted four key financial risks to ratepayers.

They included “the risk that the cost of refurbishing the reactors will be higher or lower than planned,” “the cost of operating the reactors will be higher or lower than planned,” the “risk of insufficient electricity grid demand for nuclear generation” and the risk “that the province’s commitment to nuclear refurbishment will preclude it from taking advantage of alternative, lower cost, low emissions grid-scale electricity generation options.”

The Financial Accountability Office talks about costs of refurbishing being higher or lower.

But the report documents that, historically, the cost for refurbishment has always been higher than initially budgeted. And there is preliminary evidence that the refurbishment of the Darlington nuclear plant will be more costly and take more time than projected.

The total annual demand for electricity in Ontario has also declined from 157 Terawatt-hours (TWh) in 2005, when the province began exploring refurbishing nuclear reactors, to 137.5 TWh in 2018.

To mitigate these risks, the province has some options to terminate refurbishments, called off-ramps. Because the costs of refurbishment will be greater than shifting gradually to a grid that incorporates a much larger fraction of renewables, it’s time to seriously consider these off-ramps.

Renewables are cheaper

The main reason to reconsider refurbishment is the declining costs of renewables and batteries. Globally, the costs of solar and wind energy have fallen dramatically over the past decade.

According to the International Renewable Energy Agency, the average installation cost of solar photovoltaics has declined to US$1,210 per kilowatt (kW) from US$4,621 per kW in 2010. The installation cost of onshore wind turbines has dropped to US$1,497 per kW from US$1,931 per kW.

Similar reductions have been seen in Canada too.

In the United States, one of the largest renewable energy markets in the world and one for which reliable data is available, the Wall Street advisory firm Lazard recently recorded the average construction costs of solar photovoltaics and onshore wind turbines as US$1,000 per kW and US$1,300 per kW.

In comparison, a Lazard 2013 report recorded US$1,750 per kW for both solar photovoltaic and wind energy. This decline in cost is corroborated by other sources. Nuclear power, on the other hand, has risen to US$9,550 per kW in 2019 from US$6,792 per kW in 2013.

Battery costs too have come down rapidly and analysts predict continued growth as costs continue to decline. Large-scale batteries such as Tesla’s Powerpack project are becoming more common.

Modelling and results

We developed a simple model to compare the relative costs associated with the different ways of meeting Ontario’s hourly electricity demand in 2017, as reported by the Independent Electricity System Operator.

We also assumed that the electricity sector is completely decarbonized, and no fossil fuels are used in electricity generation (there would, of course, be emissions for all sources of electricity from the manufacturing processes involved).

With this constraint, our model showed that if the costs of batteries decline from current values to those projected for 2025 by McKinsey Corporation, then the cost of supplying electricity using a combination of renewables and battery storage would become cheaper than nuclear power. That’s especially true if there are cost overruns during refurbishment.

This cost could be further reduced if the availability of hydro power is increased. This is relevant because Ontario has been urged to import more hydro power from neighbouring Québec.

While we haven’t modelled this possibility, it’s clear that a greater ability to modify demand in response to available renewables, and a greater grid capacity that could transfer more electricity between Ontario and other Canadian provinces in addition to Québec, could further lower the overall cost of electricity.

Time for the off-ramps?

The chief implication of our analysis is that it’s getting close to the time to use the off-ramps and abandon the nuclear reactor refurbishment process. To be sure, the conditions for employing off-ramps are complicated and require careful legal analysis that we’re not qualified to evaluate. However, our work does suggest that because it’s more expensive to continue to operate nuclear reactors, investing in refurbishment is not economically justified.

None of this is intended to imply that the transition to an electricity system dominated by renewables will be quick or easy. The magnitude of the shift required is immense given the overwhelming dominance of nuclear power and natural gas in Ontario’s electricity supply.

Yet the economic and climate reality justifies starting such a transition. Investing in old energy generation facilities moves us away, not towards, such a transition and locks consumers into high electricity costs for decades.

[Like what you’ve read? Want more? Sign up for The Conversation’s daily newsletter. ]![]()

MV Ramana, Simons Chair in Disarmament, Global and Human Security at the Liu Institute for Global Issues, University of British Columbia and Xiao Wei, MITACS Globalink Research Intern, University of British Columbia

This article is republished from The Conversation under a Creative Commons license. Read the original article.